ITEP: GE Defends Its Helicopter Engine

Posted on

Army National Guard AH-64 Apaches.

WASHINGTON: GE has done “an unprecedented amount” of testing to prove its T901 turbine is the best choice for the Army’s Black Hawk and Apache helicopters, company officials insisted in interviews, and they can deliver the engine a year ahead of schedule.

What about an Army review, reported by our colleagues at Defense News, that — at least according to losing bidder ATEC — shows GE had the inferior engine and won the contract only by offering the lowest price? That was a selective leak of charts taken out of context, GE replies, and it doesn’t reflect all the factors in the Army’s decision on the massive Improved Turbine Engine Program.

A UH-60 Black Hawk takes off after unloading soldiers during an air assault exercise in Germany.

“Yes, it does match part of what the Army showed us, but it’s only one piece of the full evaluation,” GE spokesman David Wilson told me this morning. “The GAO’s release of their full decision, which we expect sometime this week… will show the Army’s full evaluation and their assessment of it.”

The Government Accountability Office ruled last week to uphold the Army’s award of the Improved Turbine Engine contract to GE and dismissed a protest by rival ATEC, a joint venture of Honeywell and Pratt & Whitney. ATEC responded by trying an end run to Congress, urging legislators to effectively extend the competition by awarding them, and not just GE, Engineering & Manufacturing Development (EMD) funds to build prototype engines. It’s irresponsible, ATEC argues, for the Army to award GE the contract without testing a full-up prototype of both competitors.

“Neither competitor has run a production version of their engine on a test stand, in spite of what GE would have you believe,” a retired senior Army aviator told me.

We’ve done plenty of testing, GE replies, including tests of a prototype that — while admittedly not identical to their final proposal to the Army — is the same in all essential details.

“I could show you a cross-section and you couldn’t tell the difference,” GE exec Mike Sousa told me.

“We couldn’t tell the difference,” added Tom Champion, the director of the company’s entire advanced turboshaft engine program. There were only “subtle refinements,” he said, such as slight changes in the shape of airfoils to increase efficiency.

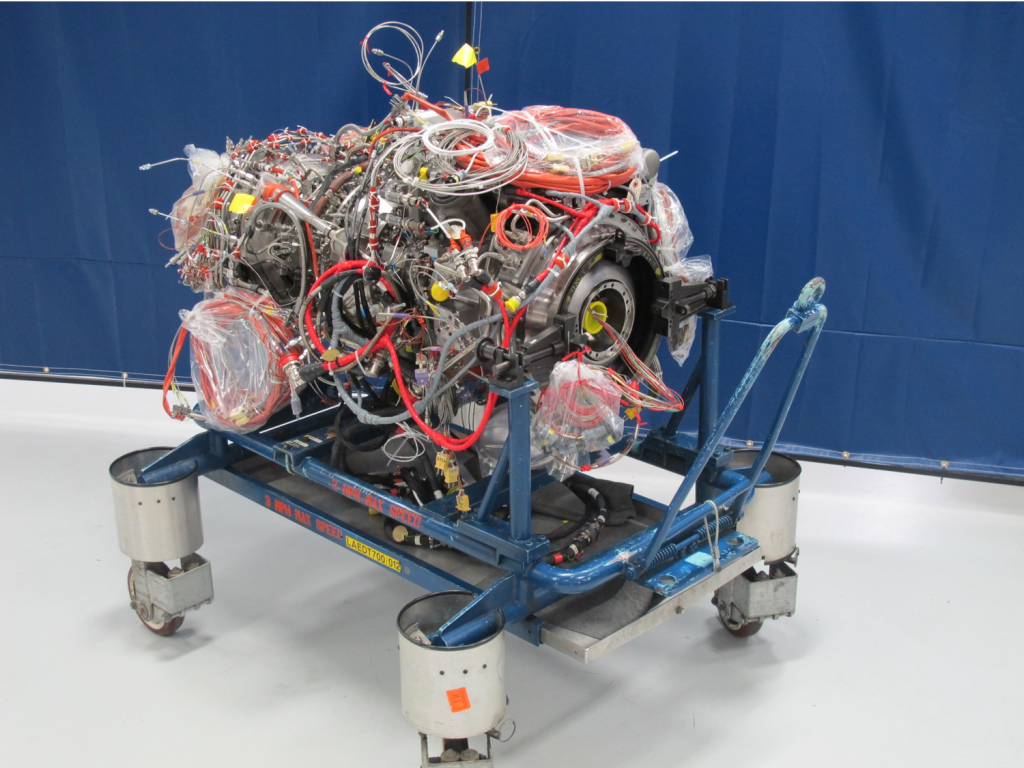

GE’s prototype of its T901 turbine, selected by the Army for its Improved Turbine Engine Program (ITEP)

Test, Test, Test

GE tested countless components and three full-up engines over the 12 years it’s worked on this technology, GE’s Champion and Sousa told me in an interview. Two of them were built during the Army’s Advanced Affordable Turbine Engine (AATE) program, which began in 2007. AATE in turn led to the first phase of the Improved Turbine Engine Program proper, the Technology Maturation & Risk Reduction phase. The Army didn’t require either GE or ATEC to produce a full-up engine for this TMRR phase, because it felt the AATE engines were enough. So ATEC didn’t build one — but GE went ahead and built a prototype anyway, at its own expense.

At the culminating event of the risk-reduction phase — the official Preliminary Design Review — “we shared all that data with the Army and they went through that in excruciating detail,” Champion said. Looking across all 12 years of work, he told me, GE has “an unprecedented amount of data prior to the launch of an EMD program.”

So, GE argues, their technology is well-proven and there’s no need to fund ATEC to do Engineering & Manufacturing Development of an alternative engine.

The leaked Army documents suggest a different interpretation. While we haven’t seen the charts ourselves, Defense News reports that the Army assessed ATEC’s proposal as lower-risk than GE’s in three important aspects: component design, systems test & evaluation, and even Engineering & Manufacturing Development. (The companies were reportedly tied in all other aspects of risk). But GE got high marks for platform integration — i.e. the ability to make the engine actually work in operational aircraft, not just on the test stand — and beat ATEC by 30 percent on price. GE also offered a plan to deliver the engine a year ahead of schedule, while ATEC only said it would try to accelerate but didn’t offer specifics, which were optional.

Defense News noted that it had only seen parts of the Army’s overall assessment of the two companies’ proposals.

“The GE spin would have you believe they have both the best value and lowest cost solution and that they have a low-risk, mature engine ready to go forward through EMD,” the retired senior Army aviator said. “I don’t think that’s the case. It looks to me like the Army once again simply picked the lowest cost solution, and they will likely find that this lowest cost solution will cost a great deal more as the program moves forward through EMD to full scale production.”

We’ll learn one way or the other soon enough. “We’re off and running and executing on the contract,” Champion told me. The routine “stop-work” order issued during GAO’s review “lifted on May 30th within an hour or so of the GAO making their decision,” he said.

Bell V-280 Valor tiltrotor in level flight with rotors facing forward. The V-280 is widely considered the leading candidate for the Future Long-Range Assault Aircraft (FLRAA)

The next big hurdle is the Critical Design Review, where the government goes over GE’s detailed designs for the engine. If it passes CDR, the company moves ahead to building and testing hardware. GE’s goal, Champion told me, is to get preliminary flight release, certifying it’s safe to start flight tests, by the end of 2022. That will make the engine available for the Army to start flight tests in 2023 on the AH-64 Apache and UH-60 Black Hawk — and potentially in the prototype Future Attack Reconnaissance Aircraft (FARA) scheduled to fly that year.

FARA is one of the Army’s two new manned aircraft, a light-weight scout that will likely serve for decades to come. What about the larger program for a larger machine, the Future Long-Range Assault Aircraft meant to replace the Black Hawk?

“What we have seen to date on [FLRRA] is it wants to have a significantly bigger engine than ITEP,” Sousa said. “[But] certainly, as part of our ITEP plan we have the ability to grow the engine.”

If GE can convince the Army to put variants of the T901, not only on its current helicopters as upgrades, but also on its future fleet, it will have a lock on sales for decades to come. That could offer real efficiencies of scale, but it’s not hardly conducive to the kind of competition a customer like the Army wants.

Subscribe to our newsletter

Promotions, new products and sales. Directly to your inbox.