Astroscale US Targets DoD Sat Servicing Market

Posted on

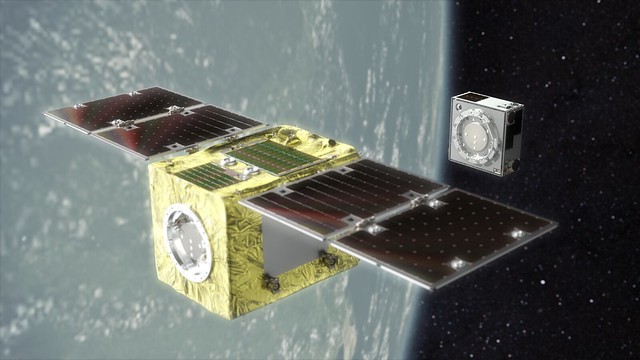

Astroscale’s ELSA-d mission

WASHINGTON: Japanese start-up Astroscale thinks its space junk technology can be used by the Pentagon for on-orbit satellite servicing, to build a foundation for its ultimate goal of building a space debris removal business, says Ron Lopez, president and managing director of the company’s new US unit.

“Debris removal is the immediate focus for the company, but there is a lot of [technology] applicability to adjacent areas of the market that end up leading to capabilities that the military needs,” Lopez explained in an interview. “DoD is a customer like any other, with a future need for servicing its own satellites to extend mission life.”

For example, Astroscale’s sensor and guidance technology that allows it to precisely rendezvous with a piece of debris could also be used by the Air Force to do the same with an active satellite, he said, to inspect it or to make repairs. Likewise, the firm’s docking technology is applicable to many types of servicing missions, such as re-fueling, that are of interest to DoD.

Astroscale US thus is seeking American partners to help it break into the military space marketplace — starting small with component and tech demos. “We are still in early stage of discussions, and trying to understand what the requirements are,” Lopez said. “We’ve been busy building partnerships with a lot of small- and mid-sized companies,” he added, to bring together “a very innovative set of technologies and capabilities” that can bring “value-added to the commercial marketplace and DoD as well.”

Astroscale launched its US subsidiary in April, opening an office near Denver and is slowly building a staff (currently number four full time employees.) The US subsidiary expands the company from the Japanese headquarters, and branches in Singapore and the United Kingdom. It recently garnered another $30 million to its Series D funding that brings the total amount of capital raised in the round to $132 million, according to the corporate website.

The company, founded by Japanese tycoon Nobu Okada in 2013, is fully aware that it is cannot make a business case for orbital debris removal today. There simply isn’t a country or a customer ready to pay to fully develop the technology required at the moment; nor is it clear that even if the technology is there customers would be incentivized to pay someone to take out their trash if there is no legal requirement to do so. Indeed, there may even be legal obstacles since the 1967 Outer Space Treaty deems debris the property of the launching state, meaning that a garbage collector would need permission of the owner to do so.

Therefore, on-orbiting servicing is a nearer-term mission that will allow the company to continue to thrive and grow. “On-orbit servicing can enable space debris removal,” Lopez summed up. “We are working with customers who have an interest in adjacent missions; those interests help us develop our core techology.”

The Air Force actively has been exploring on-orbit servicing technologies through a series of small business and tech demo projects. For example, in July, the Air Force Research Laboratory (AFRL) updated its request for information (RFI) designed to help the service get a grip on the available industrial base for autonomous Rendezvous and Proximity Operations (RPO) and “InspectorSat capabilities,” as well as the limits of current commercial technologies. Responses were due Aug. 9.

Commerce Secretary Wilbur Ross (center) visits Astroscale during Space Symposium 2019. Nobu Okada far left; Ron Lopez far right.

Further, the space industry is lobbying hard for the Commerce Department to issue new US government rules to ease development of on-orbit servicing technologies and spur the market via more coherent licensing obligations. Licensing for satellites that can perform proximity operations — that is, can safely maneuver around another satellite or a piece of debris, dock with that object, and perform some function such as re-fueling — currently falls between agency cracks. Meanwhile, the CONFERS consortium, led by the Defense Advanced Research Projects Agency (DARPA) is working to develop industry-created best practices for such tricky space operations.

Despite the hurdles for a non-US company to get its subsidiary fully credentialed to compete for DoD contracts, Lopez says being a wholly-owned Japanese company is a help, not a hindrance, because of the high level placed on cooperation in space by Tokyo and Washington. While bilateral and multilateral collaboration is often equated with simply “trying to fulfill political objectives,” Lopez stressed that it also helps the countries involved to reduce schedule and cost risks. “When we have real and evolving threats, the need is urgent and we have an environment where our tax dollars are constrained,” he said, “what that translates into is that collaboration is a way to reduce risks.”

Subscribe to our newsletter

Promotions, new products and sales. Directly to your inbox.